When it comes to home, auto, or personal property insurance, understanding how your coverage pays out after a loss is crucial. Two of the most common terms you’ll encounter are Actual Cash Value (ACV) and Replacement Cost (RC). While they may sound similar, the difference between them can mean thousands of dollars when filing a claim.

1. What Is Actual Cash Value (ACV)?

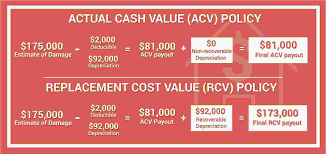

Actual Cash Value represents the depreciated value of your property at the time of loss. Insurers calculate ACV by taking the replacement cost of an item and subtracting depreciation for factors like age, wear, and usage.

🔹 Example: If your five-year-old laptop originally cost $1,200 but is now worth only $400 due to age and wear, your ACV policy will pay you about $400 after a covered loss (minus your deductible).

Pros of ACV:

- Lower insurance premiums.

- Affordable option for budget-conscious policyholders.

Cons of ACV:

- Lower payout in claims.

- May not cover the cost of replacing your items fully.

2. What Is Replacement Cost (RC)?

Replacement Cost coverage reimburses you for the amount it would take to replace the item today, without deducting for depreciation.

🔹 Example: If that same laptop is destroyed in a fire, your RC policy would cover the current cost of buying a new equivalent model—say, $1,200—even if your old one had depreciated.

Pros of RC:

- Higher claim payouts.

- Ensures you can replace items with new equivalents.

Cons of RC:

- Higher insurance premiums.

- Policies may have stricter requirements (such as proof of replacement before payout).

3. How Do They Affect Your Claim?

- ACV Policies: You’ll often receive less money than what it takes to buy new items. This can leave gaps in replacing furniture, electronics, or vehicles.

- RC Policies: You’ll usually receive enough to restore your belongings to their original condition or buy new ones.

Many insurers offer both options, but some may limit Replacement Cost coverage to certain property types or require add-ons.

4. Choosing Between ACV and RC

Which one is best for you depends on your situation:

- ACV is best if you want lower premiums and are okay covering the gap in replacement costs.

- RC is best if you want complete financial protection and don’t want to pay out of pocket to replace belongings.

5. Final Thoughts

The difference between Actual Cash Value and Replacement Cost could mean the difference between fully recovering after a disaster—or struggling to replace essentials. Always check your policy carefully and make sure your coverage aligns with your needs, budget, and long-term financial security.